To ski the glades a skier must be able to see the trees from the forest. In a way we are doing the same thing writing this buyer’s guide.

We consider all the media events and launches, press releases and catalogues, marketing speak and lofty promises and spend our winter and spring hacking at the brush to find the solid wood, the stuff that matters. A big part of that is identifying the trends shaping the future of ski gear.

The biggest trend is sustainability. In every category of ski gear there’s a move toward using cleaner energy, reducing carbon emissions and cutting chemicals. Almost every brand is integrating more recycled materials. For instance, Head’s ReThink project is a collection of ski gear, including goggles, bindings and boots, that is full of recycled and bio-based content. Bollé is using recycled content in helmet foam, along with goggle straps and plastic parts. Others are making their products more easily recyclable: G3 uses “unlock-able” adhesives in all their skis, so they can be disassembled into their different parts (plastic, wood, metal, etc.) for recycling.

But there are two Rs that come before recycling, so ski brands are also working on reducing and reusing.

Brands like Patagonia, Arc’teryx, Rab and others have in-house repair capabilities to keep gear in use longer. To that end, some companies are making their gear more repairable (like Apple, but without the government legislation). A great example: all the parts on Phaenom’s first ski boots are replaceable. There’s also a growing resell market. Arc’teryx and Patagonia buy back their old gear, refurbish it and then resell it, while The North Face and others host open marketplaces anyone can use to resell their gear.

Another macro trend is diversity. It’s not easy to make snowy slopes more accessible, but gear brands are now trying—an important development with an aging demographic. Nordica and Rossignol are making ski boots that require less bending down to get on and adjust. Outdoor Research, Columbia and MEC are expanding their apparel sizing to accommodate bigger and smaller skiers. One of our favourites is MEC’s roomy, plus-size Helix jacket for women that looks good, feels good and fits well. And Parlor, a New England custom ski maker, developed the KBF, the first ski built for the specific demands of sit-skiers.

We highlight many other trends shaping ski gear this year and beyond. We also highlight some of the key products that transcend marketing hype. Our hope is that it offers a view of the forest and the trees, and helps you find the gear you need for the best winter ever.

SKIS

VERSATILITY IS IN

Is thinner a winner or is fatter better? When it comes to skis, both can be true at the same time.

On the thin side, the last time dedicated carving skis were this popular was before social media when shaped skis were still blowing minds. The proof: even freeride brands like RMU, Black Crows and Zag are dabbling with hard snow rippers.

The trend holds across fatter ski categories also. The western all-mountain ski sweet spot is now below 100mm waist width, and even the powder skis are shrinking from 120mm or more to around 115mm. (Read more about powder ski trends in the Powder issue, coming next month.)

“This industry always ebbs and flows, and after years of 105mm to 110mm skis driving sales we’re certainly returning to a more versatile all-mountain ski being sought after,” says Jade Keene, part owner of Ski Tak Hut on Vancouver Island.

The same is true in the East, but in the opposite direction. Skiers are trading true carving skis for all-mountain skis in the 80mm to 90mm range, says Andrew McDonald, Sporting Life’s senior hardgoods buyer.

The move to the middle may be a product of inflation and logic. Rather than a ski for every condition, skiers are simplifying their quiver. And since most of us spend most of our time at the resort, where the competition is more often for fresh corduroy instead of powder, a more versatile ski makes sense.

Along with the shift toward versatility, another notable trend is that several brands remodelled some of their most popular skis.

“Most of these changes focus around making these skis a bit more approachable for all,” says Jordan Sunshine, the ski buyer for evo.

Finally, there’s a continual blending of freestyle and freeride into an emerging category of super playful, twin-tipped all-mountain skis.

You’ll find these trends highlighted in the following write-ups of 13 skis that we thought were notable. We go into far more depth in the on-snow Ski Canada Ski Test (available in the 2025 Buyer’s Guide).

OZEMPIC ON SNOW

Manufacturers are honing in on the 80mm to 100mm waist window for all-mountain skis. On the narrower side are carving weapons with enough forgiveness and versatility to hop into the bumps and wiggle through trees. On the wider end are the more backside-oriented all-mountain skis with enough girth to float through powder, and enough precision and power for groomer carving.

•••

STÖCKLI LASER MX

_ The women’s MX is a carving ski with a surprising knack for skiing in varied terrain. The all-mountain versatility comes from a lightweight construction, tip and tail rocker, and a Titanal layer with a cosine wave slit through it to ease up on stiffness at slower speeds. It rails like a race ski, but is agile and friendly off-piste. $1,879; stoeckli.ch

•••

VÖLKL PEREGRINE

_ Völkl renamed the expansive Deacon family of frontside, all-mountain skis Peregrine and added an 80 and 82 width. It’s a sweet spot for a hard snow weapon. A new tip shape and tailored Titanal layer eases them up just enough to play nice in the soft stuff. From $1,350; volkl.com

•••

FISCHER THE CURV GT 85

_ The widest of Fischer’s aptly named Curv family, the 85 is a shapely beast. The dramatic sidecut features three radii, which improves turn shape versatility. It’s a ski that’s happiest riding on edge, but doesn’t feel out of its element playing in the bumps and off piste. $1,100; fischersports.com

•••

ROSSIGNOL ARCADE

_ To design the new Arcade, Rossignol combined technology from two opposing elements. From the race side comes a full sidewall and a Titanal beam. From freeride comes the lightweight air tip, an oversized sidecut plus tip and tail rocker. The all-mountain ski comes in two widths, 84mm and 88mm. From $949; rossignol.com

•••

BLIZZARD ANOMALY AND BLACK PEARL

_ Blizzard’s all-mountain bulls, the Brahmas, Bonafide and Cochise, are now the four-ski Anomaly family with widths ranging from 84mm to 102mm. Blizzard kept the character of the bulls, but tweaked the sidecut, rocker and the beech-poplar wood core. The biggest change, though, is the Titanal layer. It’s now three pieces, which eases up the torsional rigidity. On the women’s side the Black Pearl keeps its name but undergoes a similar transformation. From $850; blizzard-tecnica.com

•••

ATOMIC MAVERICK AND MAVEN

_ If there’s an exception to the slimming trend it’s the Maverick and women’s Maven. Atomic is adding three bigger siblings to its metal, all-mountain ski families. Along with the existing five models in the 86mm to 95mm width range, there are new Maverick 105 CTI and 115 CTI widths and a Maven in 103 CTI. It’s not all deviation from the norm, though. The bevelled tip shape, called HRZN 3D, increases surface area and the core is a stiff, damp and powerful mix of ash, poplar, carbon and Titanal. For its width it has surprising float and edge grip. In other words, it’s a charger aiming at being a quiver of one. Watch for a full review in the fall issue. From $900; atomic.com

FREESTYLE FREERIDE

The twintip is returning from relegation. Driven by relentless progression in backcountry freestyle and by park and pipe skiers looking for sticks that can rip the rest of the hill too, the double tip is venturing beyond its comfort zone to explore the whole mountain. The new skis are durable, playful and surfy.

•••

HEAD OBLIVION

_Launched last year and refined for this winter, the five-ski Oblivion line includes two models designed by Canadian freeskier Cole Richardson. The 102 and 116 mix poplar wood and recycled water bottles in the core with carbon layers. The combination keeps the weight low but stability and power high for charging around the mountain and stomping airs. From $699; head.com

•••

K2 RECKONER

_Soft tips, torsional stiffness under foot, lots of rocker and a relatively light weight: the re-vamped Reckoners are made for turning the ski hill into a playground. Widths for the four-ski line start at 92mm and range up to the beefy 124mm. All have twin tips for sliding backwards and landing switch. From $500; k2snow.com

•••

FACTION STUDIO

_ Designed in collaboration with Faction’s athletes, the Studio is a twintip ski intended for high-speed skiing. They have a reinforced wooden core, stomp pads to soften hard landings and carbon construction to keep the weight down. From $800; ca.factionskis.com

•••

SCOTT SEA

_ Standing for Ski Everywhere Anytime, the focus of the three SEA models (88, 98 and 108) is about versatility. Construction leans toward all-mountain capability, with Titanal bands, a poplar core and bevelled edges near the tip and tail for easy turn initiation and release and a floaty feel in powder. $900; scott-sports.com

REVAMPING FAN FAVOURITES

Messing with something popular is risky. But so is standing still. This year several manufacturers balanced these two forces, tweaking some popular ski families to make them better.

•••

ELAN RIPSTICK

_ Elan added flax fibres for dampening and extra carbon to increase stiffness and rigidity. It retains the lightweight wood core, Amphibio design (dedicated left and right ski) and slanted sidewalls. From $850; elansports.com

•••

NORDICA ENFORCER AND SANTA ANA

_ For the Enforcer’s 10th birthday Nordica increased nimbleness with more tip and tail rocker and added rubber elastomers under the binding for shock absorption. The metal sandwich combines with a poplar-beech core, a remodelling repeated in the women’s Santa Ana. From $800; nordica.com

•••

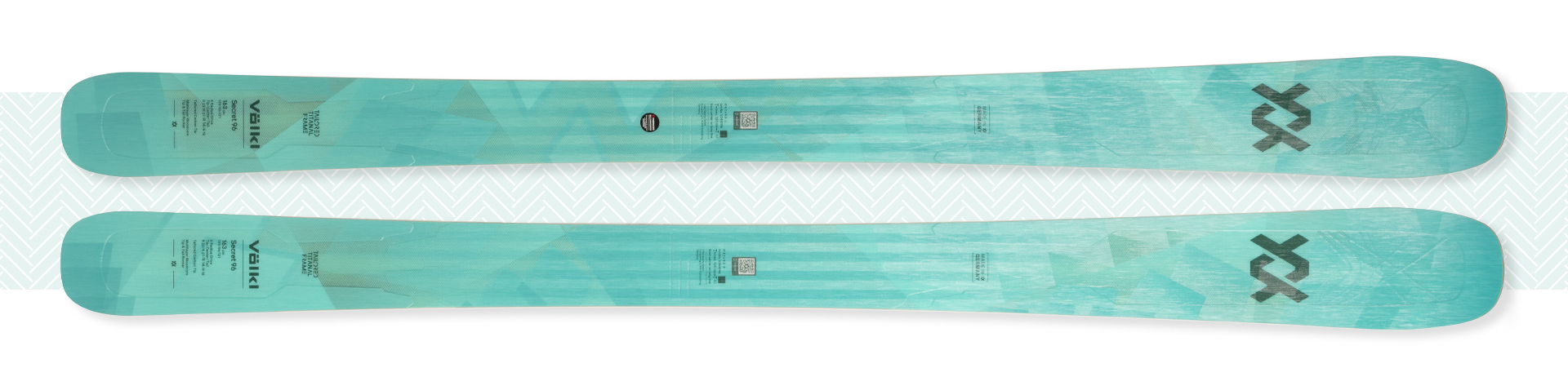

VÖLKL MANTRA AND SECRET

_ Now onto its seventh iteration of its flagship Mantra 96, Völkl has added a fourth radius to the sidecut for even more turn shape versatility. With a Titanal layer tuned to each length, carbon tips and a multi-layer wood core, the M7 remains a beefy, powerful ski most suited to strong, hard-charging skiers. The women’s Secret 96 undergoes a similar tweak, while the Secret 102 and 88 and equivalent men’s widths (108, 102 and 88) remain unchanged. From $949; volkl.com

WHAT DO WOMEN WANT?

For the last few decades ski brands thought it was pretty clear: women want their own skis. Many brands invested in specific designs catering to women’s unique physiology. The problem is there is conflicting evidence whether women, in all their different shapes and sizes, can be put into a box that’s usefully distinct from the box containing all the various shapes and sizes of men. So several ski brands are pushing back by going unisex.

Fischer was a leader with the Ranger, which comes in two colour options for every width to appeal to different tastes. Now Line is doing the same by turning the women’s Pandora line into a unisex family of all-mountain skis. Founded in 2020, the Season brand went universal from the outset. Their all-black skis aren’t just genderless, but also timeless. Only time and sales will tell if that’s what women really want. From $649; lineskis.com. From $650; seasoneqpt.com

GET MORE BUYER’S GUIDE: